Every day welcome to our 80c news today long time no ATC video I say be negated McNamara para lighten up all night angle inaudible Tanaka wrangling flat right, so our topic today is common mistake but up additional government withholding taxes at parrot poetess among entrepreneurs or not be business non equipment and goods or services government agency local man or national government agency so panel upon Ithaca see we have a common mistake so example PO nation see business owner entrepreneur an acquaintance of goods or service Kai government examples when I think ionic bench I like men to push on goods or service worth 100,000 pesos Sonar Poor Anand admired bombastic government agency business owner 100,000 Poo bah ammonia Hindi customer on being withholding taxes Delaney class support on withholding taxes none government did not go up on the night of Arab yarn supplier goods or service in this case the business owner pot, so one is income tax non Aleppo is young business tax okay Kaepernick bent upon type and goods or goods government agency like your money see people over the national government agency couple Goods bomb beneath a narcotic bits' owner may be the holding period a 1% of the 100,000 pesos okay parable but registered boutique business owner that angle in Monaco in 12% but begun he multiplies a 1% income tax withholding Queen okay Miller Park Service non-permanent and business owner a government like tarpaulin printing famous I Raymond lights so service prominent and it is Masonic a government agency even with multiple government agency no income tax I 2% okay kappa but registered see business owner that angle in moon appoint 12 percent but don't say fine young bonanza Bhagavan multiplies at 2% para one a but the man supplier goods...

PDF editing your way

Complete or edit your how to download bir form 2307 to desktop anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2307 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your PH BIR Form 2307 2005 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your PH BIR Form 2307 2005 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare PH BIR Form 2307 2018-2025

About PH BIR Form 2307 2005

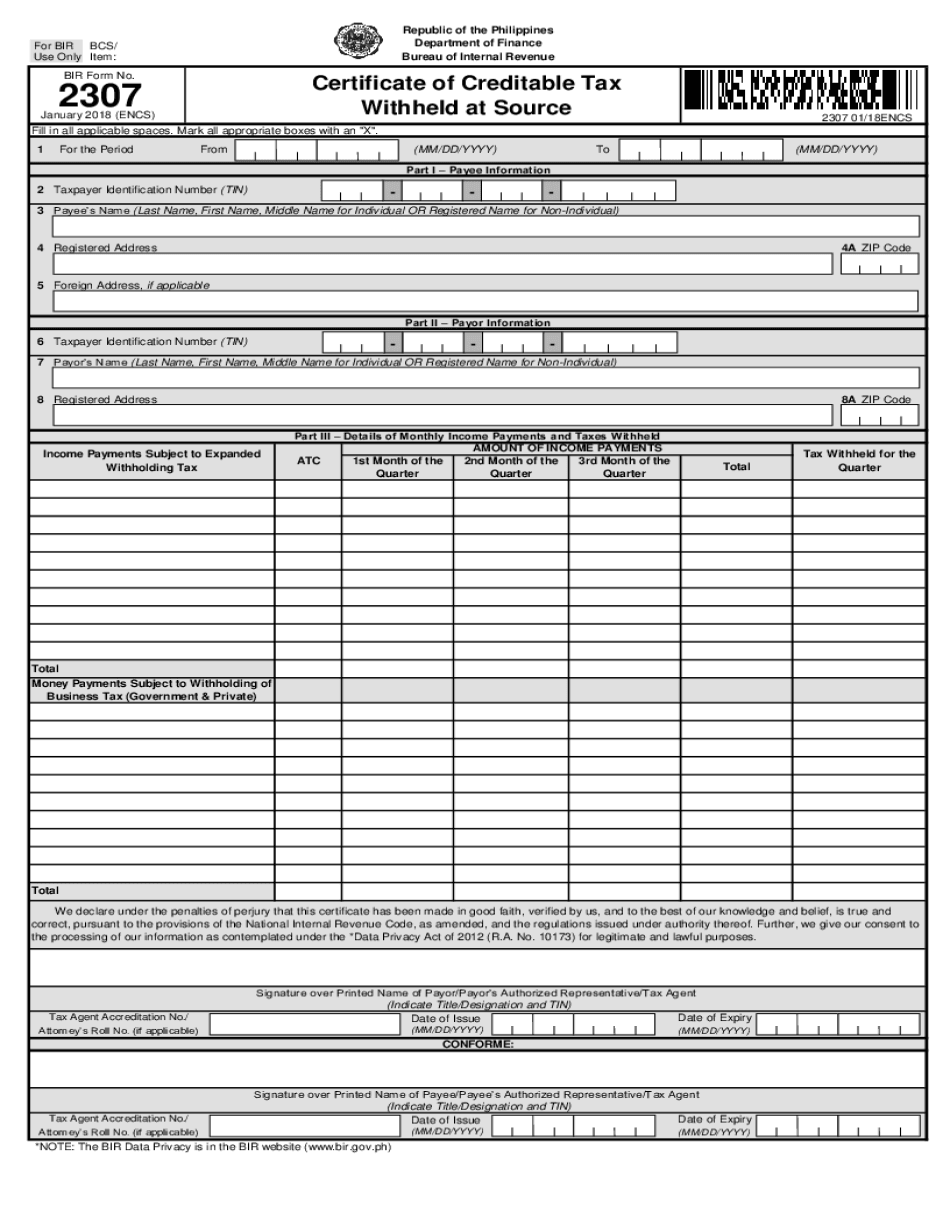

PH BIR Form 2307 2025 is a document issued by the Bureau of Internal Revenue (BIR) in the Philippines. It is a certificate of creditable tax withheld at source, which serves as proof that an individual or a business has paid taxes on payments received from another entity. Form 2307 is required by the BIR for individuals or businesses receiving income subject to creditable withholding taxes, such as professional fees, rental income, or commission fees. It is also required for those receiving services from contractors, suppliers, or sellers of goods subject to creditable withholding taxes. In summary, anyone who receives income from a source subject to creditable withholding taxes in the Philippines must submit PH BIR Form 2307 2025 to the BIR as evidence of tax payment.

Online remedies help you to manage your record management along with improve the output of the work-flow. Follow the speedy guide to complete PH BIR 2307 Form 2307 2005, avoid errors along with print promptly:

How to complete the PH BIR 2307 Form 2307 2025 on the web: - On the site together with the template, just click Start Now and complete towards the editor.

- Use the actual hints to fill out the kind of areas.

- Add your individual details and make contact with info.

- Make sure you enter correct info and numbers within proper job areas.

- Very carefully confirm the articles from the PDF and also sentence structure and punctuation.

- Refer to Support part for those who have any queries as well as handle the Assistance group.

- Put an electronic unique on your own PH BIR 2307 Form 2307 2025 with the aid of Indicator Instrument.

- As soon as the form is completed, push Done.

- Send out the particular ready file by way of email as well as send, printing against each other or even reduce your system.

PDF editor permits you to make changes in your PH BIR 2307 Form 2307 2025 from the internet connected gadget, colorize it for you based on your needs, indicator that in electronic format as well as deliver diversely.

What people say about us

Digitally delivering forms in the new field of remote work

Video instructions and help with filling out and completing PH BIR Form 2307 2018-2025